TikTok: Why young people have to delay ‘adulting’

Charlie Buckland,BBC News

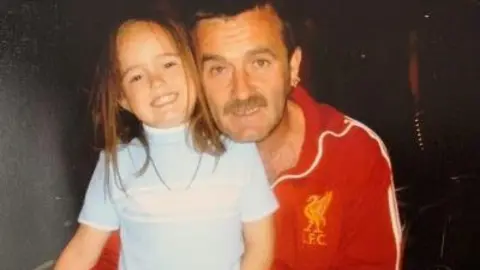

Ellie Harris

Ellie Harris

Get married, buy a house and have children. That’s how most of our parents did it and they probably think other people should too.

However a TikTok trend with more than 27 million views has highlighted that achieving “traditional” life milestones is becoming increasingly out of reach for young people, with many pushing them aside until later in life.

In these videos, young people do side by side comparisons of their parents at a certain age versus them at that age now.

Often the parents are in the housing market and married with kids, whereas things are very different for their own children.

But Ellie Harris, 25, whose parents were married with three children at her age, said people underestimate that it was a “completely different time”.

She is encouraging others to recognise their own wins, whether that is leaving a job where they are unhappy or taking up running, and not to compare with the generations before them.

Ellie Harris

Ellie Harris

In a study the charity Relate found that 95% of Gen Z and 88% of millennials felt there are certain life milestones that society should better recognise, including running a marathon, leaving an unhealthy relationship or quitting a job.

Gen Z people tend to be anyone born between 1997 and 2012 while millennials are born between around 1980 to 1997.

The Resolution Foundation recently said that 18-34 year olds in 1997 were on average in a couple in their own home whereas today, people in that demographic are living at home with their parents.

The Building Society Association said one of the biggest barriers to buying property was affording the mortgage repayments and raising the deposit to buy.

kmacfalls

kmacfalls

Ellie, from Merthyr Tydfil, who still lives with her mother, said she had no intention of settling down soon.

She said she did not know how they did it in those days, and now is “a completely different time”, where “your wage just doesn’t back it all up”.

“It’s not that we don’t want to do those things, it’s just that it’s out of reach at the moment.

“I wouldn’t be able to buy a home on my salary alone now, I would have to do it with someone.”

Ellie Harris

Ellie Harris

“I travelled to the other side of the world – I think that’s a huge milestone.”

She said the opportunities to travel were not there for her parents, and they encourage her to see the world.

“My mam always says she doesn’t regret any of her choices, but she wishes she had done more.”

Natalie Earley

Natalie Earley

Natalie Earley, 28, is in a similar situation. Her parents were married and had bought a house at the same age, which feels worlds apart compared to where she is now.

Natalie has had a partner for some time but does not see buying a home, marriage or children in her near future, and she is happy with that.

She said: “I have lived in a house share since university.

“While I’m comfortable with not owning my own home, it’s completely out of reach for me financially.”

Natalie said she used to feel the pressure as she would see some of her friends achieve those milestones, but she no longer worries about it.

“Travelling really opened my eyes, we’re all stuck in a rat race here in the UK,” she said.

“It’s just not a priority for me and while traditional milestones should still be celebrated there is so much more to life too.

“If we feel like celebrating something then it’s worth celebrating, especially if you’re proud of it.”

Owain Caron James of Darogan Talent, which is a hub which supports graduates into work, said there is an increasing need for a dual income to afford a home.

“On average when our parents were buying homes, house prices were four times greater than the average salaries. By now it’s over eight times,” he said.

“There is a big change and a huge need for a dual income.

“If you’re not bringing that combining power of another person it’s very difficult to get on that housing ladder.”

‘Coffee won’t make dent in housing deposit’

Personal finance expert Laura Pomfret said the economic landscape between older generations and millennials and Gen Z’s is vastly different.

“Enjoying a coffee each week won’t make a dent in a housing deposit,” Laura said.

She described the economic situation as completely outside their control.

“Without the support from parents or inheritance, mathematically it is a lot harder for younger generations to think about those big investments.”