Business news |

By Nick Flaherty

Arrow is heading for a fall of 16% in its revenue in 2024, triggering a $185m restructuring of the business.

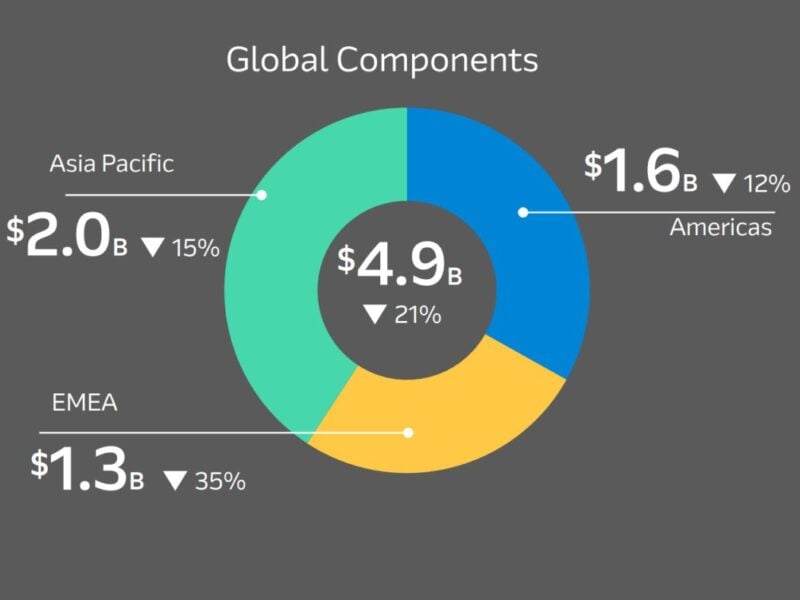

The company saw a fall of 35% in its component distribution business in Europe in 2024 as it heads to a overall fall of 16% this year.

The business in the Americas grew sequentially with strength across several verticals lead by Aerospace & defense but saw a decline in the industrial market, says CEO Sean Kerins. Even so, the component distribution business in the region fell 12%. The $2bn enterprise computing business grew 7%, boosted by demand for AI.

The European market saw broad-based declines from entering the downturn later than other regions. This led to overall sales of $6.8bn in the third quarter, down 15% from $8.0bn in the same quarter last year.

Arrow expects revenue of $6.67bn to $7.27bn in Q4, giving a mid range forecast for the full year of $27.58bn. This would be 16% down on the $33.11bn revenue last year.

The company reduced inventory by $125m in the quarter, which is a factor slowing the distribution market. It is also restructuring its business in a move that aims to save $90 to $100m over the next two years but will cost $185m with $110m for staff layoffs and $50m to sell non-core businesses. Arrow has a media business called Aspencore that publishes EETimes and Power Electronics News.

If you enjoyed this article, you will like the following ones: don’t miss them by subscribing to :

If you enjoyed this article, you will like the following ones: don’t miss them by subscribing to :