Outlook for pay ‘far from rosy’ after Budget

Getty Images

Getty Images

People won’t feel much better off by the end of this parliament, according to the Resolution Foundation’s analysis of the Budget, with the outlook for pay “far from rosy”.

In the Budget the chancellor increased the rate, and the starting point, at which employers pay National Insurance Contributions (NICs) for their staff.

That amounted to a “tax on working people”, James Smith of the Resolution Foundation said.

Other Budget measures, including a big boost to spending, and other tax rises, are expected to raise inflation in the short term, which could prevent interest rates falling more quickly.

Mr Smith, research director at the economic think tank, said the rise in NICs would be reflected in smaller pay rises.

“This is definitely a tax on working people, let’s be very clear about that.

“Even if it doesn’t show up in pay packets from day one, it will eventually feed through to lower wages,” he said.

Chancellor Rachel Reeves admitted to the BBC it was likely that her tax-raising Budget may affect pay for workers, as businesses would have to absorb the costs of paying more National Insurance.

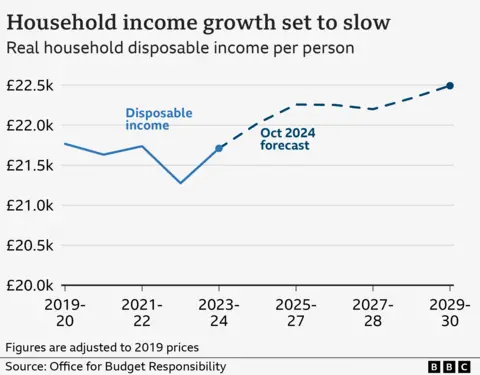

She said it was likely wage rises would be smaller but that overall the OBR forecast that household income would increase, which, she claimed, was much better than predictions under the Tory government.

The Budget has sparked a debate over whether an increase in employers’ NICs will feed through to smaller pay rises for workers, or whether firms can absorb the higher costs in other ways.

The OBR’s analysis said 60% would be passed on.

Pay before tax is levied, is still expected to rise over the course of the parliament, but only slowly – by 1.7% over four years, the Foundation said, in part due to the impact of the rise in employer NICs.

Household incomes, taking into account tax and benefit payments, will also rise only slowly – by an average of 0.5% a year – over the course of the parliament, the poverty focused think tank said.

The Resolution Foundation described it as “a stagnation of average living standards”.

However, it pointed out that the income growth is slightly faster than the 0.3% average annual growth between 2019 and 2024, a period which saw a number of economic blows, including Brexit, the pandemic, and energy price rises following Russia’s invasion of Ukraine.

The effect of an ageing population is also putting more stress on public finances especially through higher demand for health services.

The Resolution Foundation also highlighted the decision to retain the two-child limit on claiming universal credit and tax credit, plus the failure to repeg Local Housing Allowance to rising rents, as having a particularly negative impact on those on low incomes.

Slower growth will also undermine progress on improving living standards, according to analysis from the Resolution Foundation think tank.

Reeves’ decision to increase taxes and borrowing to raise funding for public services and investment is a clear move away from the cuts set out by the previous government, it said.

But it warned the Budget “has not yet delivered a decisive shift away from Britain’s record as a ‘stagnation nation’,” as the outlook for both growth and living standards remains weak.

On Wednesday, Reeves announced Labour’s first Budget since 2010, after the party’s return to power in July’s general election.

“The short-term effect of these changes will be better-funded public services,” Mike Brewer, interim chief executive of the Resolution Foundation, said.

“But families are also set for a further squeeze on living standards as the rise in employer National Insurance dampens wage growth,” he added.

The new tax and benefits policies will affect everyone, said the think tank, which aims to improve living standards for low-to-middle income families.

Disposable incomes – the amount people have to spend once taxes and benefits have been taken into account – are expected to grow more slowly due to the measures in the Budget. Real household disposable income per person is projected to grow by 0.5% a year on average across the parliament.

The Resolution Foundation calculated the incomes of the poorest half of households will grow by 0.8% less than they would have otherwise.

The richest half face a reduction in where their income would have been of 0.6%.

Wealthy households are expected to experience the biggest overall impact due to capital gains and inheritance tax changes.

The foundation expects wage rises to be hit by a combination of an already challenging outlook, weaker growth due to increased taxes on employment and higher inflation.

This will mean that by 2028 real weekly wages will have grown by just £13 over the past two decades, it said.

There could be more spending increases and more tax rises to come over the next two years, according to the Institute for Fiscal Studies (IFS), a respected economics think tank.

Chancellor Rachel Reeves insisted on Wednesday that her huge revenue-raising Budget was a one-off move to “wipe the slate clean” and not something she “would want to repeat”.

But Paul Johnson, head of the IFS, told the BBC that pressures to keep spending on public services would be hard to resist.

“I suspect we’ll end up with even more spending, possibly considerably more spending than is currently planned,” he said.

“That will probably mean, unless she gets lucky with growth, more tax rises to come next year or the year after,” he told BBC Radio 4’s Today Programme.

He said Reeves’ Budget contained a large amount of additional spending this year, followed by a fair bit next year. After that spending was set to grow “implausibly slowly”, Mr Johnson said.

“It’s possible she’ll argue that spending rises so much this year and next that no more money will be needed for the next three years of this parliament,” he said.

But, in the absence of much stronger-than-forecast economic growth, he thought further spending and taxes rises were much more likely.

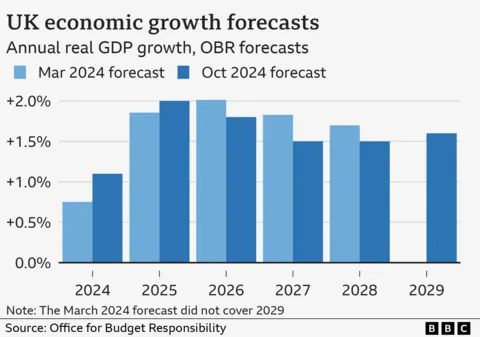

Growth forecasts published alongside the Budget suggest UK growth will pick up over the next two years, but then fall back to a more moderate pace, in large part due to Budget measures that are likely to push up prices and interest rates.

Mr Johnson described the forecasts as “pretty awful”.

In its general election manifesto, Labour promised not to increase taxes on working people – explicitly ruling out a rise in VAT, National Insurance or income tax.

The pledge has come under scrutiny, with some claiming that the rise in the National Insurance rate paid by employers breaks that pledge, something the government has denied.

The Resolution Foundation also warned that the decision to frontload increases to spending on public services into this year and next means the Spending Review in the Spring will be tough.

Reeves has also left herself with a “relatively slim margin of headroom”, it said.

The chancellor’s new debt rule allows more room to manoeuvre but most of that money has already been used up, which means that even a small economic downturn could force the government to increase taxes further in the future, the think tank said.

Reeves told the BBC on Wednesday that “this is not the sort of Budget we would want to repeat“.

“This is the Budget that is needed to wipe the slate clean and to put our public finances on a firm trajectory,” she said.

Health, education and transport will see spending increases, with the biggest hike in funding for the NHS since 2010 – £22bn extra for the front line and another £3bn for equipment and buildings.