By Natalie Sherman

Business reporter, New York

A co-founder of FTX told a court that a tweet sent by Sam Bankman-Fried assuring that the cryptocurrency exchange was “fine” was false.

Former executive Gary Wang said when Mr Bankman-Fried made the post he was aware that the firm faced an $8bn hole. It declared bankruptcy days later.

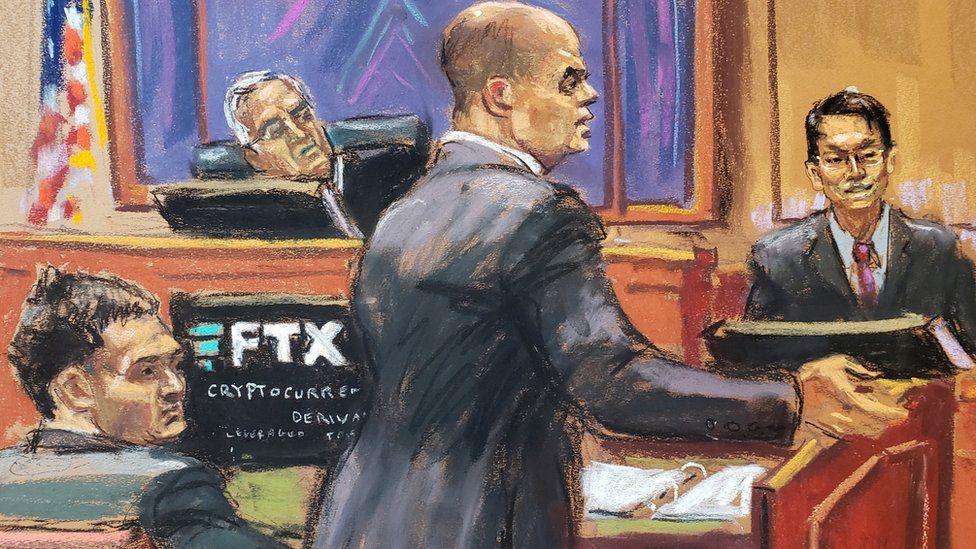

Mr Wang was testifying in court in New York, where Mr Bankman-Fried is on trial for fraud.

Mr Wang has already pleaded guilty.

The 30-year-old, a friend from high school maths camp who became chief technology officer at FTX, took the stand for a second day on Friday, answering questions about spreadsheets, tweets and private chats as prosecutors probed the gap between the firm’s public face and its inner workings.

Mr Wang said Mr Bankman-Fried had repeatedly made public claims about the firm’s financial health that were not based on reality.

“FTX was not fine,” Mr Wang said. “Assets were not fine, because FTX did not have enough assets for customer withdrawals.”

FTX collapsed into bankruptcy in November last year as a flood of customers tried to withdraw their money.

Soon after, Mr Bankman-Fried was charged with fraud, money laundering, accused of stealing money from FTX customers, and lying to investors and lenders. He has denied the charges against him.

The Department of Justice has alleged he funnelled the money of customers into property purchases, political donations, marketing and other spending through Alameda, a crypto trading firm Mr Bankman-Fried had founded a few years earlier.

“We said publicly that we would not use customer funds like this,” Mr Wang told the court.

Before FTX’s bankruptcy, Mr Wang said he and Mr Bankman-Fried discussed the steadily growing hole on the firm’s balance sheet, created by massive withdrawals of customer funds by Alameda.

As early as the end of 2019, Alameda was already withdrawing more than what FTX took in from fees charged to customer trading on its platform, he said.

The court heard by June 2022, Mr Bankman-Fried had asked for a review of Alameda’s debts to FTX, leaving top executives debating via spreadsheet how to calculate the true number. Mr Wang that month put that figure at roughly $11bn.

Alameda’s account had features – including a $65bn line of credit at FTX and the ability to run a negative balance – that made it unique, he said, despite public claims to the contrary.

In one instance in 2019, a few months after starting FTX, Mr Bankman-Fried wrote on Twitter that his trading firm, Alameda, had an account on the exchange that was “just like everyone else’s”.

That same day, Mr Wang said, Mr Bankman-Fried asked him to tweak the platform’s code, allowing Alameda to withdraw unlimited funds.

In another instance, the FTX boss posted about the amount held in a fund supposed to protect in the event of losses using what prosecutors called a “fake number”.

Christian Everdell, Mr Bankman-Fried’s lawyer, had less than an hour to cross-examine Mr Wang before the court session ended for the day.

He suggested that the unique features of Alameda’s account were due to its role on the platform as a “market-maker” responsible for helping trading flow smoothly.

The trial is expected to last six weeks. Mr Wang will continue to testify next week, followed by Caroline Ellison, Mr Bankman-Fried’s former girlfriend and the former chief executive of Alameda, who has also pleaded guilty.